So, student loan forgiveness. A curious choice of words, forgiveness – makes it sound like the borrower committed a moral error. I read an interesting take on this. The opinionator, himself a student loan recipient, leads off with a bit of virtue signalling, assuring readers that he is in fact paying off his considerable student loan debt but nevertheless believes there’s no reason to resent Biden’s latest act of grace.

As often happens I found certain comments more insightful than the piece itself, wherein the author opined

In order to have a shot at the American dream, my generation is paying – in the form of very, very large student loans – an American dream tax. This tax has led many Americans and thousands of Mainers to be so burdened with student loan debt that we cannot move forward in other areas of life. This is something previous generations did not face.

One commenter disputed this one-size-fits-all notion of the “American Dream” calling it instead a nightmare that is (or ought to be) avoided by many. And then replied to her (?) own comment with a more nuanced view

One other comment: The “American Dream” is defined differently by different people. For many where I live it’s a cookie cutter colonial in an upscale neighborhood with two cars (SUVs), kids, Carnival cruise vacations and a chemically “perfect” green lawn that is killing off our pollinators and wildlife.

Snarky! Especially the alliterative flourish “cookie cutter colonial.” But also the “perfect green lawn” belying an ecological disaster wrought by chemicals. This conjured in my mind the opening scene of David Lynch’s very fine film, Blue Velvet. That kind of wit is hard to pull off in writing and not something I expect to see in the comment section to an opinion piece in a local newspaper, but I’m always pleased when I do.

…

I don’t feel like I have anything important to add to either the pro or con side of the various arguments out there. And I’m not one of the eligible recipients of $10K of debt relief, someone making $75K/year working a job I didn’t go to school for, living with two kids and a non-working spouse in a two-bedroom apartment with one used car in need of repair and no prospect of saving enough to buy a starter house. Even if one were available in a place where I could afford to live and work. If I were that person I might feel no shame looking a taxpayer in the eye and saying $10K is the least this government can give me to help me get over the hump.

On the other hand, once upon a time I was a Pell grant government-backed loan recipient. At the time I gambled I’d be able to pay it off someday. How, I really had no idea. Things worked out for me, I graduated, got a good job and paid off the loan in seven (?) years. Every one of those years I got a new coupon book in the mail with twelve payment slips, one for each month the next payment was due. Postage not included – which only added to my debt burden! It never occurred to me the government would (or should) payoff that loan for me, or that anyone else would for that matter. I was a grown-up, I’d borrowed the money, it was on me to pay it back. But again, I was fortunate to get and keep a good paying job, so I could afford the monthly payment and have some salary left over for other stuff. It wasn’t a lot of leftover money, even in 1985 dollars. At the time I lived in a modest one bedroom apartment in north Texas with a working spouse. We owned a beater Pontiac and new VW GTI, 90% financed. Another coupon book! I recall it took us six months to save for a washer and dryer. But we were DINKS. After putting away a bit in savings, we’d dispose of leftover salary at clubs and pool parties. Open-house style parties sponsored by the apartment management looking to lure new renters. Most every weekend we’d look forward to all you could drink frozen daiquiris, Texas-sized beers, and bottomless helpings of sloppy joes and potato chips. Dinner and drinks at someone else’s expense! One less trip to the grocery store. That’s how we saw it back then. Life was good. I suppose to us it felt like the American Dream, or a feature of it anyway.

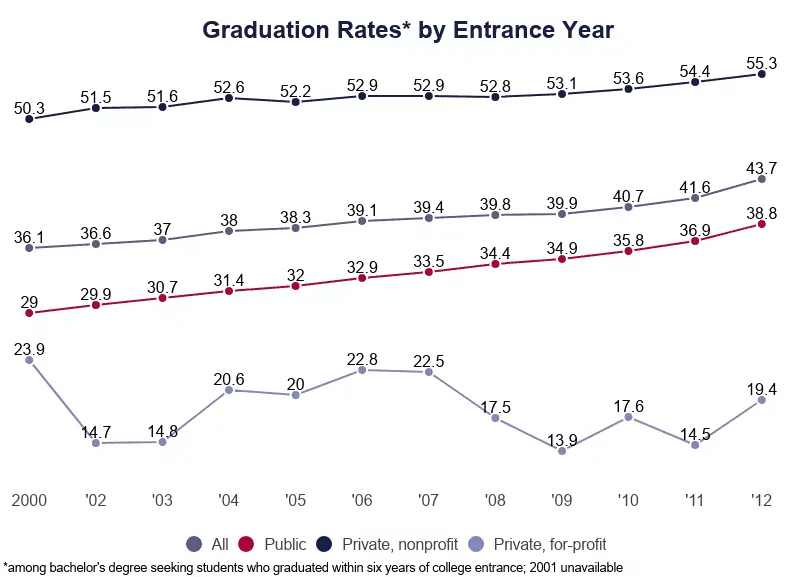

Yeah, but those were different times, right? Yes and no. Getting a government loan to pay for four years of college isn’t very different today than it was in 1980. It is still the case that a lot of academically aimless kids enter college with no clue what they’ll major in. And less than two in five freshman who matriculate a public college will graduate with a four-year degree (much worse at for-profit colleges). There’s been some improvement in two decades but it’s still pretty dismal. Point is, there is a real risk of default by the borrower if she drops out early or graduates with a degree for which there is little or no market demand. This is the cohort of recipients eligible for student loan forgiveness I feel the least sympathy for, the one least worthy of it, yet for all I know may need it the most.

A Whitehouse analysis claims the lion’s share of forgiveness will go to borrowers earning $75K a year or less. In 1985, my starting salary in Texas was ~ $31K/year. That’s roughly $88K in 2022 dollars. Eligibility-wise, that would’ve put me in the 13% category (below) had there been an equivalent program in 1985. But you know, sitting around the pool soaking up rays, partying like it was our birthright, didn’t feel like hardship to me. So I wonder how many of those 87% – or certainly the 13% – are really in hardship with no foreseeable chance of getting above water with their finances anytime soon in order that they might enjoy The American Dream. Versus how many have been living well beyond their means, where a $10K jolt of forgiveness is going to suddenly right them into fiscal austerity, and set them on a course to enjoy the American Dream, like they imagine their fellow Americans must be enjoying. The former class of recipients I have some sympathy for, the latter, not so much.

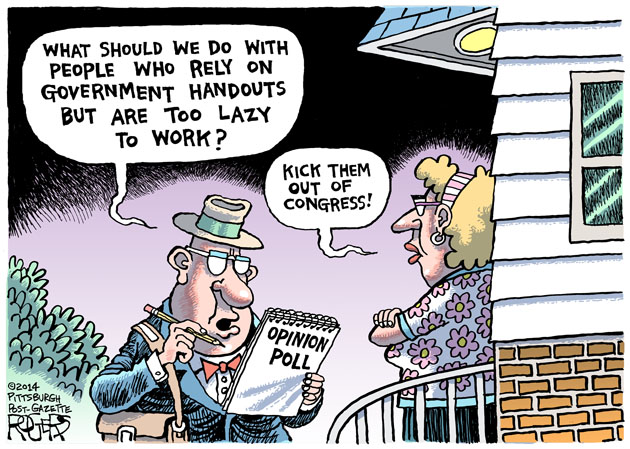

This leaves unanswered the question of whether or not the government should use taxpayer dollars to relieve some or all the debt of a certain class of borrowers, deserving or not. On the one hand we’re talking about a government that recently spent over what, four trillion dollars to keep us at home? And trillions more to fight pointless wars abroad. In that light, a couple hundred billion to make the lives of a few tens of millions of Americans a little better off doesn’t exactly get my back hairs up. On the other hand, we should not want a government overeager to help people avoid having to overcome the consequences of poor judgment, more or less by their own lights. At the very least we should want the government to be very selective about who gets help; yes to the no-fault-of-our-own cohort; no to the where’s-my-American-Dream complainers. I am not holding my breath.